Introduction to the Israel-Palestine Conflict

The Israel-Palestine conflict has long been a topic of heated debate and international concern. This complex geopolitical issue not only affects the lives of millions, but it also extends its reach to unexpected corners of the world – including the bustling real estate market in the United Arab Emirates (UAE). With tensions flaring between these two nations, it’s only natural that ripples are felt throughout the global economy. In this blog post, we will explore how the Israel-Palestine case impacts real estate in UAE and what it means for investors, homeowners, and developers alike. So fasten your seatbelts as we delve into this intriguing connection between political unrest and property markets!

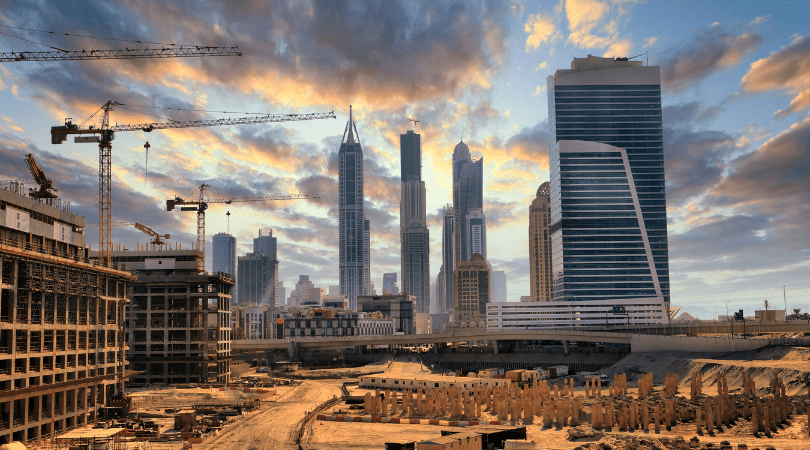

The Impact Of The Conflict On Real Estate In UAE

The ongoing conflict between Israel and Palestine has had a significant impact on various aspects of the global economy, including real estate markets. The United Arab Emirates (UAE), being a key player in the Middle East, has not been immune to these effects.

One notable change resulting from the conflict is the shift in demand for properties in the UAE. As tensions escalate, many individuals and businesses are looking for safer investment opportunities outside of countries directly involved in the conflict. This has led to an increase in inquiries and transactions within the UAE’s real estate market.

Moreover, property prices have experienced fluctuations due to geopolitical uncertainties surrounding Israel-Palestine tensions. Investors seeking stability may opt for properties in regions less affected by these conflicts, such as Dubai or Abu Dhabi. Conversely, some speculators might take advantage of price drops caused by apprehension and invest with hopes of future appreciation.

Foreign investors also see potential opportunities arising from this situation. With increasing interest from international buyers, developers are incentivized to create attractive deals tailored towards foreign investors’ preferences. This can lead to new construction projects and innovative real estate offerings that cater specifically to this demographic.

To cope with instability caused by regional conflicts like that between Israel and Palestine, it is crucial for real estate professionals to adopt strategic approaches. Diversifying investments across different sectors within the industry can help mitigate risks associated with political unrest or economic downturns.

In addition to diversification strategies, staying informed about geopolitical developments is essential when dealing with any market impacted by conflicts or uncertainties. Keeping track of news updates and understanding their potential implications allows professionals operating within UAE’s real estate sector to make informed decisions.

While it is challenging to predict how long-lasting impacts will be during periods of heightened tension like those seen between Israel and Palestine, one thing remains clear: adaptability is key when navigating through uncertain times.

✳️Full Sea View! | Vacant | Price Dropped✳️

Al Rahba, Al Muneera, Al Raha Beach, Abu Dhabi- Beds: 3

- Baths: 4

- 1922 sqft

- Apartment

⚡️Full Sea View! High Level | Modified Kitchen⚡️

Al Rahba, Al Muneera, Al Raha Beach, Abu Dhabi- Beds: 3

- Baths: 4

- 1922 sqft

- Apartment

⚡ Genuine Price | Tenanted Unit | Urban View ⚡

Julphar Residence, Al Reem Island, Abu Dhabi- Bed: 1

- Baths: 2

- 737 sqft

- Apartment

⚡️Low Premium | Corner | Prestigious Location⚡️

Nouran Living, Saadiyat Island, Abu Dhabi- Bed: 1

- Bath: 1

- 842 sqft

- Apartment

⚡️ HOT DEAL!!! Single Row | Close to Facilities ⚡️

Aspens, Yas Acres, Yas Island, Abu Dhabi- Beds: 4

- Baths: 5

- 4969 sqft

- Townhouse

✳️ Overlooking the Mangroves | Single Row V4 ✳️

Seef Al Jubail, Al Jubail Island, Abu Dhabi- Beds: 4

- Baths: 5

- 9430 sqft

- Villa

Changes in Demand for Properties in UAE

The Israel-Palestine conflict has had a profound impact on various aspects of life, including the real estate market in the United Arab Emirates (UAE). With regional tensions and instability escalating, it’s no surprise that there have been significant changes in demand for properties.

One noticeable trend is an increase in demand for safe havens within the UAE. Investors who are seeking stability and security amidst the uncertain geopolitical climate are turning to Dubai and other Emirates as attractive options. The robust legal system, strong infrastructure, and transparent property regulations make the UAE an appealing destination for those looking to safeguard their investments.

Moreover, there has been a shift towards commercial properties rather than residential ones. Businesses recognize the strategic location of the UAE as a gateway between East and West, making it an ideal hub for trade and commerce. As companies continue to expand into this region, office spaces have become highly sought after assets.

Additionally, there has been a surge in interest from international buyers who see potential opportunities emerging from this conflict. Many investors perceive that political uncertainties may result in lower property prices or distressed sales. Consequently, they view this as an opportune moment to enter or expand their portfolio within the UAE real estate market.

On another note, some local residents may be hesitant about investing domestically due to concerns over safety and stability caused by tensions related to Israel-Palestine conflict. This cautious approach may temporarily affect domestic demand but is likely to rebound once calm is restored.

In conclusion, The Israel-Palestine case has brought about notable changes in property demand within the UAE’s real estate market. The increased interest from foreigners seeking stability alongside growing preference for commercial properties reflect evolving investor strategies during times of uncertainty. While these changes may introduce short-term fluctuations within specific sectors of the market locally, they also present unique investment opportunities that can benefit both domestic stakeholders and foreign investors alike.

Effects on Property Prices

The Israel-Palestine conflict has had a significant impact on the real estate market in the UAE, particularly when it comes to property prices. As tensions rise and instability increases in the region, investors become more cautious, leading to fluctuations in property prices.

In times of uncertainty, demand for properties tends to decrease as potential buyers adopt a wait-and-see approach. This decline in demand can put downward pressure on prices. Additionally, some investors may choose to exit their positions or delay their investment plans altogether until the situation stabilizes.

Conversely, there are instances where heightened geopolitical tensions have actually led to an increase in property prices. In certain cases, individuals seeking safe havens for their investments view stable markets like the UAE as attractive options amidst global turmoil. This increased demand can drive up property prices.

It is important to note that these effects on property prices are not solely determined by the Israel-Palestine conflict but also influenced by various other factors such as economic conditions and government policies.

While the conflict can create short-term volatility in property prices, long-term stability and growth prospects of the UAE’s real estate sector remain strong. Investors should carefully analyze market trends and seek guidance from industry experts to make informed decisions during uncertain times.

Opportunities for Foreign Investors

For foreign investors, the Israel-Palestine conflict has created unique opportunities in the real estate market of the UAE. The instability and uncertainty in neighboring regions have led many investors to seek safer investment options, and the UAE offers a stable business environment with attractive returns.

One of the key opportunities lies in commercial real estate. As businesses and individuals look for alternative locations to establish their operations or relocate, there is a growing demand for office spaces, retail outlets, and industrial properties in the UAE. This increased demand translates into higher rental yields and potential capital appreciation for foreign investors.

Another avenue that presents promising prospects is residential real estate. The influx of expatriates moving to the UAE due to political unrest in nearby countries has fueled demand for housing. Foreign investors can take advantage of this by investing in residential properties like apartments or villas, which offer both long-term rental income potential and capital gains.

Additionally, strategic partnerships between developers and international investors have gained momentum as they collaborate on large-scale projects such as mixed-use developments or luxury resorts. These partnerships provide a platform for foreigners to invest directly into high-value projects while leveraging local expertise.

The government’s initiatives aimed at attracting foreign investment further contribute to these opportunities. With investor-friendly policies like 100% ownership rights for selected sectors and tax incentives, it becomes even more enticing for international buyers to invest in UAE real estate.

In conclusion (not part of this section), while conflicts may disrupt stability elsewhere, they present openings in other regions like the UAE where real estate markets thrive amidst uncertainty. Foreign investors should carefully consider these opportunities when diversifying their portfolios as they navigate through geopolitical challenges across borders

Strategies for Coping with Instability

In times of conflict and political uncertainty, it is crucial for individuals and businesses to develop strategies to cope with instability. This holds true in the context of the Israel-Palestine conflict and its impact on real estate in the UAE.

One strategy that can be adopted is diversification. Investing in a range of properties across different locations can help mitigate risks associated with geopolitical tensions. By spreading their investments, individuals can reduce their exposure to potential disruptions caused by conflicts.

Another approach is staying informed and being adaptable. Keeping a close eye on developments related to the conflict can provide valuable insights into market trends and dynamics. Being proactive and flexible allows investors to adjust their strategies accordingly, enabling them to make informed decisions based on changing circumstances.

Building strong relationships with local partners is also essential during times of instability. Collaborating closely with trusted real estate agents, lawyers, or property management companies who have extensive knowledge of the local market can provide invaluable support in navigating challenges posed by geopolitical uncertainties.

Furthermore, maintaining financial stability is vital amidst periods of political unrest. Ensuring a healthy cash flow, minimizing debt levels, and having contingency plans in place are all key factors when dealing with volatile markets affected by external conflicts.

Lastly – patience pays off! It’s important not to panic when faced with uncertainty brought about by geopolitical events such as the Israel-Palestine conflict. Markets tend to recover over time after experiencing short-term fluctuations due to political crises. Therefore, adopting a long-term perspective may prove beneficial for those looking at investing or holding onto properties during turbulent times.

By implementing these strategies – diversifying investments, staying informed but adaptable, building strong relationships locally while maintaining financial stability – individuals and businesses can better navigate through unstable periods resulting from conflicts like that between Israel and Palestine while minimizing potential risks along the way

Conclusion

The Israel-Palestine conflict has undoubtedly had an impact on the real estate market in UAE. The changes in demand for properties, fluctuating property prices, and opportunities for foreign investors have all been influenced by the ongoing tensions between these two nations. While some may view this instability as a cause for concern, it is important to remember that with challenges come opportunities. Foreign investors can take advantage of lower property prices and potentially capitalize on future stability in the region.

However, navigating through these uncertain times requires careful planning and strategy. It is crucial to stay informed about geopolitical developments and work closely with trusted advisors who are well-versed in the nuances of this complex situation. Despite the challenges posed by the Israel-Palestine conflict, UAE’s real estate market remains resilient. With its strong infrastructure, strategic location, and business-friendly environment, it continues to be an attractive destination for both local and international investors.

As we look towards a more peaceful future in which resolution is found between Israel and Palestine, it is hopeful that stability will return to both nations – which will subsequently have a positive impact on real estate markets across the region. While there may be temporary fluctuations caused by political unrest, it is essential to recognize that investing in UAE’s real estate sector can still yield long-term benefits. By carefully assessing risks and staying vigilant amidst changing dynamics, individuals can navigate through these challenging times successfully.